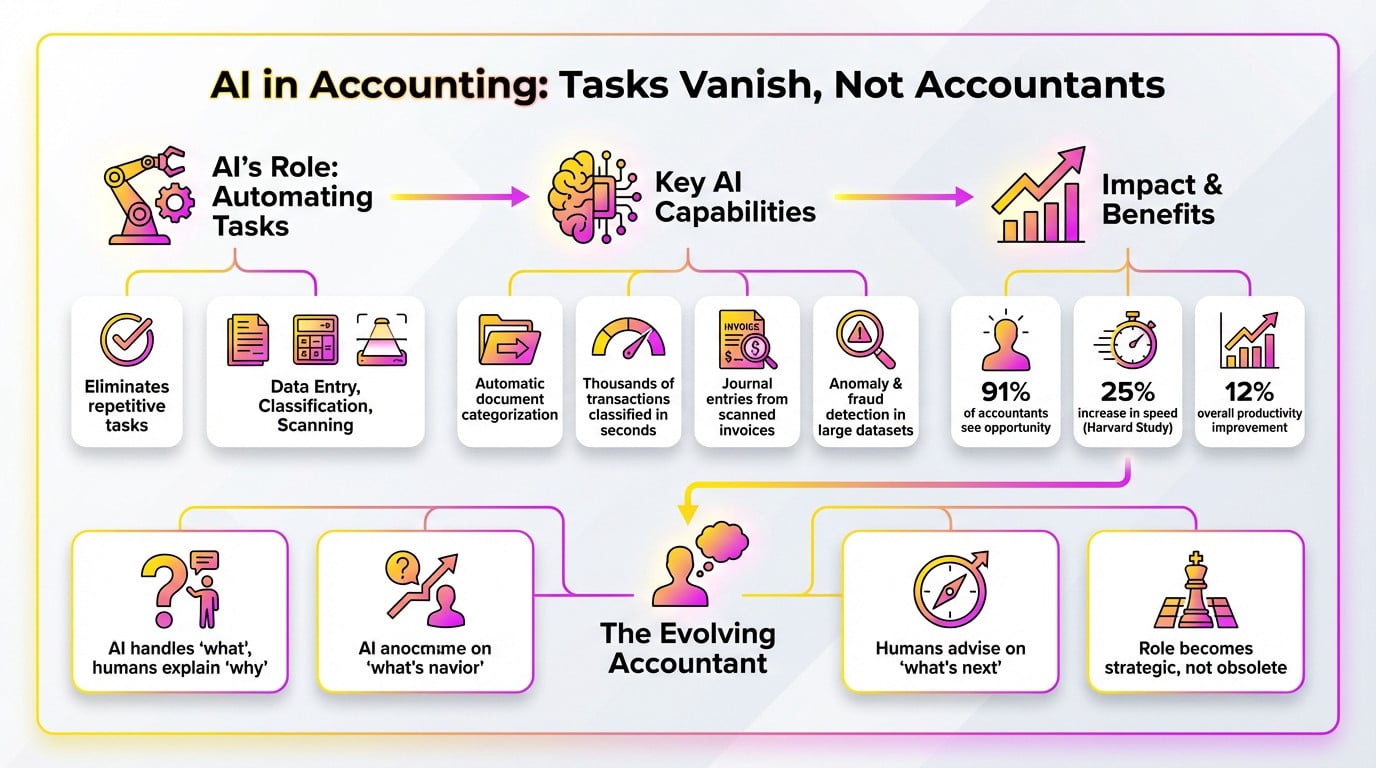

The essential takeaway: AI is not here to replace accountants, but to eliminate the repetitive drudgery of data entry. This transformation elevates the profession, shifting focus from manual compliance to high-value strategic advisory. With 91% of experts viewing this as an opportunity rather than a threat, the future lies in leveraging these tools to boost productivity and deepen client trust.

Do you lie awake at night worrying will ai replace accountants and render your hard-earned CPA license completely obsolete in the next few years? The reality is fortunately less dystopian, as this technology is actually here to obliterate the soul-crushing data entry tasks you secretly hate rather than your entire career. We are about to explore how this seismic shift empowers you to trade boring spreadsheets for high-value advisory roles, proving once and for all that the human touch is the one asset no algorithm can ever replicate.

The Real Score: Tasks Are Vanishing, Not Accountants

So What Is AI Actually Doing to Accounting Jobs?

Everyone asks if ai replace accountants. The short answer? No. It is actually slaughtering the boring, repetitive drudgery that nobody in their right mind enjoyed anyway.

We need to draw a hard line here. It is about automating specific, mindless tasks, not wiping out the entire professional role.

The industry isn’t running scared; they are leaning in. In fact, 91% of finance pros see this as a massive opportunity. A solid 71% have already experimented with generative tools because the upside is undeniable.

The Grunt Work Is Officially on Notice

Let’s get specific about what’s hitting the chopping block. We are talking about the mind-numbing agony of manual data entry, transaction classification, and scanning endless piles of invoices.

But it goes deeper than just typing numbers. AI now analyzes complex bank feeds and even drafts basic emails or executive summaries for clients.

- Automatic categorization of accounting documents.

- Classification of thousands of transactions in seconds.

- Generation of journal entries from scanned invoices.

- Anomaly and fraud pattern detection in large datasets.

The Productivity Boost Is Real—and Measurable

You want hard numbers? A Harvard study proves the point. Consultants using AI saw a 25% jump in speed and a 12% improvement in overall productivity. This isn’t just abstract theory; it is a quantifiable impact.

This doesn’t mean you work less; it means you work smarter. You get to the meat of the matter much faster.

Speed isn’t the only endgame here. It is about freeing up human brainpower for work that actually moves the needle.

Why This Isn’t the End of the Line

Here is the bottom line. Automating a spreadsheet is not the same thing as replicating a professional’s judgment, ethics, and years of hard-earned experience.

The machine handles the “what” efficiently. The human is still desperately needed to explain the “why” and advise on the “what’s next.”

This is a clear evolution, not an extinction event. The role is shifting to become more strategic, not obsolete.

The New Job Description: From Number Cruncher to Strategic Pilot

So, if AI is handling the boring stuff, what’s actually left for an accountant to do? A lot, it turns out—and it’s far more interesting.

Stepping into the Advisor’s Shoes

Let’s address the elephant in the room: will ai replace accountants? Not the smart ones. The time saved from automation is directly reinvested into higher-value advisory services. You become a genuine business partner, a strategist, and a financial guide.

This is exactly what clients have always wanted: not just a dusty report of past numbers, but actionable, forward-looking advice.

The focus moves from compliance and reporting to performance and growth strategy. It’s a fundamental change in purpose.

The Communication-First Accountant

Here is a secret: accounting has always been a communication-based profession. This technological shift just brings that reality to the absolute forefront.

Skills like active listening, explaining complex financial data in simple terms, and building client trust become paramount. These are deeply human skills.

The AI can provide the raw data, but the accountant must build the relationship and provide the context.

A New Toolkit: From Reconciliation to Prediction

We are witnessing a massive move towards predictive accounting. Smart firms use AI to anticipate cash flow needs and identify operational risks before they happen.

This allows accountants to be proactive rather than reactive. You can warn a client about a future problem instead of just reporting on a past one.

You need to visualize this shift to understand the opportunity. The old tasks are gone, replaced by high-level thinking. Check out this comparison of where the industry is going right now.

| Traditional Tasks (Automated by AI) | Evolved Focus (Human-Led) |

|---|---|

| Data entry and reconciliation | Strategic financial planning and forecasting |

| Manual transaction classification | Client advisory and business growth consulting |

| Generating standard reports | Interpreting complex data and providing actionable insights |

| Repetitive compliance checks | Risk management and ethical oversight |

The Human Firewall: Why AI Can’t Take the Hot Seat

The Accountability Gap: Who’s Liable When the AI is Wrong?

You can’t sue an algorithm. If a bot hallucinates a tax deduction, it won’t face legal consequences or professional sanctions. This liability void is exactly why ai replace accountants remains a myth; the machine has zero skin in the game. It simply cannot be held responsible.

A human professional, a CPA, carries that legal and ethical weight on their shoulders. Their name, license, and livelihood are on the line with every single signature.

Until an AI can sign a legal document and accept liability, it will always be a tool, not a replacement.

Navigating the Gray Areas of Regulation and Ethics

Accounting isn’t just math; it’s about contextual judgment. Tax laws are filled with ambiguities, exceptions, and weird “edge cases” that don’t fit a pattern. You need to read between the lines.

AI operates on rigid rules and historical data; it struggles with interpreting the spirit of a law versus the letter of the law.

A human accountant can understand a client’s specific context, risk tolerance, and long-term goals to make a judgment call that a machine can’t. That’s where true expertise lies. We see the human story behind the numbers.

The Irreplaceable Trust Factor in Client Relationships

Business owners confide in their accountants about sensitive financial matters. This requires a deep level of trust built over time through authentic interaction. It is a relationship, not a transaction.

An algorithm can process your data, but it can’t offer reassurance during a cash flow crisis or understand the non-financial context behind a business decision.

That human connection, empathy, and trusted counsel are things that clients pay for and that AI cannot replicate.

The Hidden Risks: Hallucinations, Data Leaks, and Skill Decay

It’s easy to get excited about the upside, but ignoring the pitfalls of these AI tools is a recipe for disaster. They are powerful, but they are not perfect. The lingering question of will ai replace accountants often distracts us from these immediate, tangible threats.

When the AI Confidently Gets It Wrong

You need to understand the concept of “AI hallucinations” right now. Generative AI can, and does, produce plausible-sounding but completely fabricated information. In accounting, this isn’t just a simple error; it’s a potential legal nightmare.

This is exactly why human oversight is non-negotiable. Every single output from an AI must be checked and validated by a professional. If you don’t verify, you are liable.

The AI is an assistant, a very fast one, but it’s not the final authority.

Your Client’s Data Isn’t Always Safe

We must also address the serious risk of data security. Feeding sensitive client financial data into third-party AI models can be a major breach of confidentiality. You are exposing secrets.

Relying blindly on AI without rigorous human oversight is not just lazy; it’s a professional liability waiting to happen, with real consequences for clients and firms.

Firms need clear policies and secure, private AI environments to manage this risk effectively. The convenience can’t come at the cost of security.

The Real Danger of ‘Deskilling’ the Profession

We face a serious point about skill decay in our workforce. If junior accountants no longer perform fundamental tasks, how do they build the foundational knowledge needed to become senior experts? They skip the learning curve.

Over-reliance on AI could create a generation of professionals who can’t spot an error because they never learned how to do the task manually.

This is a long-term risk to the profession that needs to be addressed through new training and mentorship models.

The Talent Pipeline Is Breaking: Training the Next Generation

That risk of deskilling leads to an even bigger question: if the old career path is gone, how do we build the accountants of the future?

What Happens to the Entry-Level Job?

Let’s be brutally honest about the state of graduate work. The traditional entry-level grind, focused entirely on manual data entry and bank reconciliation, is rapidly disappearing from the firm. Those learning tasks are gone.

This creates a massive headache known as the “broken pipeline” problem. We used to rely on that grunt work to teach the basics, but now that first rung of the career ladder is being automated away completely.

So, will ai replace accountants at the junior level? No, but it means the junior role itself has to change dramatically to survive.

From Data Entry to AI Supervision

Here is the new reality for anyone starting today. Instead of doing the heavy lifting, juniors will be supervising the AI that does the work. Their job becomes 100% about validation, quality control, and handling the weird exceptions.

They will be the first line of defense against AI hallucinations and errors. This requires a different, more analytical skillset from day one, because you can’t spot a machine’s mistake if you don’t understand the logic.

It is less about bookkeeping and more about managing an AI agent. That is the new baseline.

The New Skills Every Accountant Needs to Learn Now

The standard curriculum for accounting is already painfully outdated. The focus must shift immediately from memorizing manual processes to mastering these new competencies. We are playing catch-up.

This isn’t just about being “tech-savvy” or knowing Excel shortcuts. It is about developing specific, hybrid skills that combine accounting principles with the mindset of a data scientist.

Here is the toolkit you actually need to stay relevant:

- Data Analytics and Visualization: Interpreting large datasets and presenting findings clearly.

- AI System Auditing: The ability to test, validate, and trust the output of AI models.

- Business Advisory and Strategy: Translating financial data into forward-looking business advice.

- Prompt Engineering for Finance: Knowing how to ask AI the right questions to get accurate, relevant answers.

The Road Ahead: Adapting to a Future With AI as a Partner

The change is happening whether we like it or not. The only choice left is how to respond—and the smart firms are already making their moves.

External Forces Are Pushing the Change

You can’t ignore the external pressure accelerating adoption. Take the mandatory electronic invoicing reform in France, kicking off in September 2026. It is a perfect case study of how regulatory shifts force technological upgrades.

This reform creates a massive, standardized dataset that humans simply can’t handle alone. AI is the only practical way to process and derive value from it.

When government mandates dictate the pace, adopting these tools stops being an option—it becomes a necessity for survival.

Building a Safe Framework for AI Use in Your Firm

But let’s be real: you can’t just let employees use any random bot they find. That is a recipe for disaster. You need a formal strategy and strict governance.

Start by creating an internal charter. This document must set hard rules on data privacy, specific tool selection, and the validation procedures everyone must follow.

To keep your firm secure while innovating, you need to implement a structured approach that covers every base, from daily operations to legal compliance.

- Develop a Clear AI Usage Policy: Define which tools are approved and for what purposes.

- Prioritize Continuous Team Training: Keep staff updated on both capabilities and risks.

- Implement a Human-in-the-Loop System: Mandate human review for all critical AI outputs.

- Stay Informed on Regulations: Follow developments like the EU’s AI Act.

It’s About Partnership, Not Replacement

We need to kill the “AI vs. Humans” narrative right now. It is dead wrong. The reality is “AI with Humans.” That is where the magic happens.

The fear that ai replace accountants is misplaced. The future belongs to professionals who learn to work with these tools, using them to enhance their expertise and deliver more value. It is a partner, not a competitor.

You should be watching regulations like the EU’s AI Act closely, while investing in the right AI tools to stay ahead.

Ultimately, AI isn’t here to steal your desk; it’s here to clear off the paperwork piling up on it. The future belongs to accountants who combine technical precision with human insight. Don’t fear the algorithm—audit it, guide it, and use it to become the strategic partner your clients actually need.