The essentials to remember: The selected free AI tools offer a high-performance, secure solution for the banking and insurance sectors. With no hidden fees or registration, they optimize processes while

In an industry where compliance and data security are paramount, banking, credit and insurance professionals often struggle to find affordable, high-performance AI solutions, limiting their ability to optimize their processes and stay competitive. Our rigorous selection highlights three free ia, specifically designed for industry needs, with proven functionality and full compliance with security and privacy standards. Discover how these tools guarantee substantial time savings, optimum protection of sensitive data and unrivalled accuracy to optimize your critical processes and strengthen your competitive edge in a demanding regulated environment.

The rise of free artificial intelligence: a performance driver for demanding sectors

Artificial intelligence is now an integral part of business processes, from the automation of credit files to the rapid management of insurance claims. It is a concrete tool for improving productivity and operational efficiency. In regulated sectors such as banking and insurance, its adoption needs to be carefully considered and secured to meet legal requirements while optimizing costs.

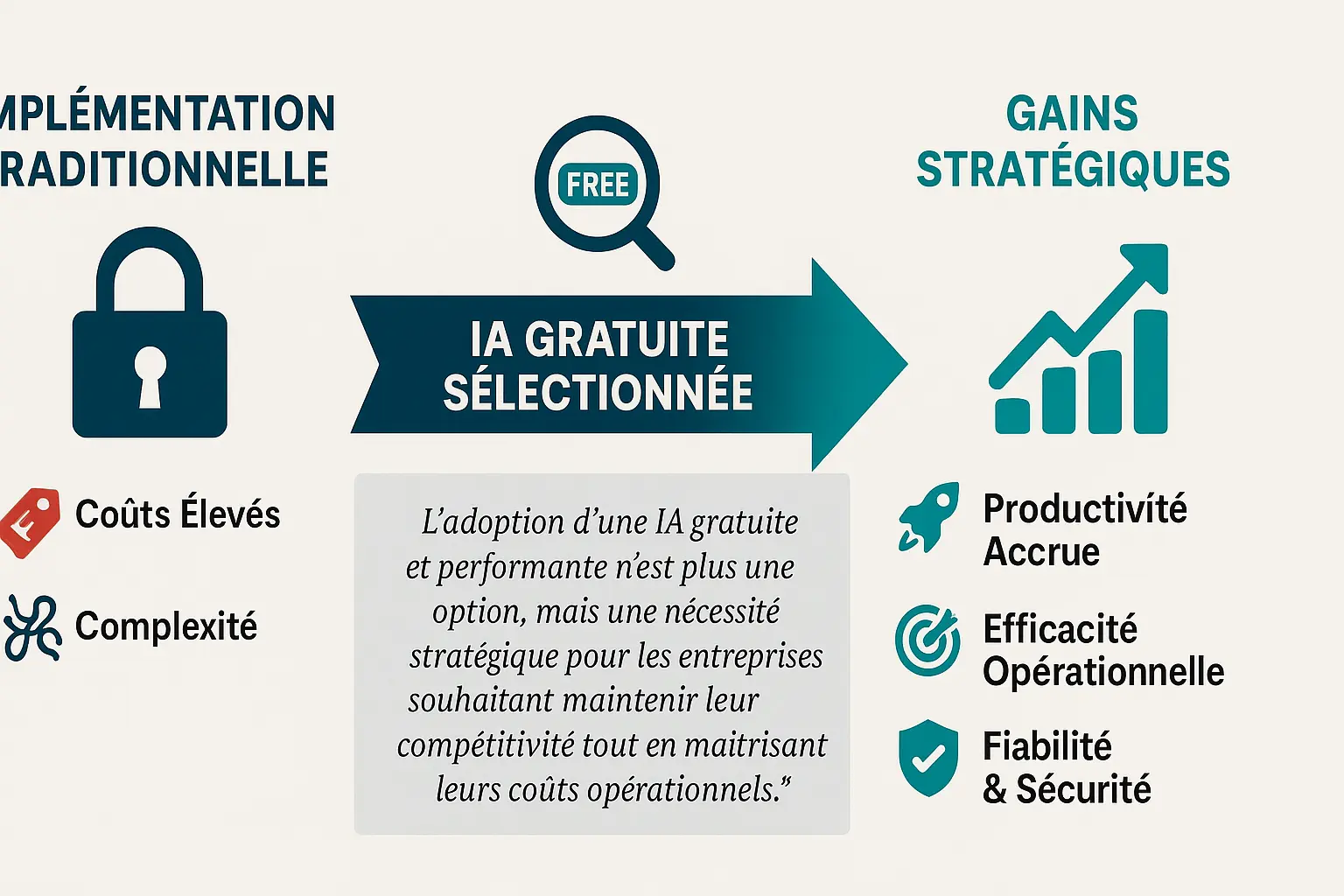

Many AI solutions are expensive or complex to deploy. This article introduces Nation AI, Chatbot GPT and Yiaho, three free and accessible tools with no hidden fees or misleading trial periods, tailored to banking and insurance needs. We’ll detail their features, benefits and reliability for professionals, automating critical processes in complete security.

Adopting free, high-performance AI is a strategic necessity for maintaining competitiveness and controlling operating costs.

Nation AI analysis: the versatile free conversational solution

Nation AI overview

Nation AI is a free platform developed by Paris-based UPLIKE. No registration required for basic access. Data security is a top priority, with RGPD-compliant European hosting.

Users benefit from an intuitive, secure interface. No installation required. Instant access from any device. Protect your data with a solution that complies with French and European laws.

Key features and benefits for professionals

Nation AI excels in text generation for e-mails, contracts and financial reports. It analyzes complex documents and supports strategic decision-making. Save time and standardize communications.

The platform also lets you create professional images and chatbots. Templates are regularly updated for greater precision. Ideal for the specific needs of the banking and insurance sectors.

Banking professionals benefit from reliable automation, reducing risk and optimizing operational costs. Without it, costly errors could occur.

Focus on Chatbot GPT: free AI for all

Introducing Chatbot GPT

GPT chatbot, free without registration, uses OpenAI APIs (GPT-4/GPT-4o) via Botnation.ai. RGPD and European standards compliant, with enhanced security for sensitive data. Optimized for French-speaking professionals, fast and reliable generation.

Accessible on chatbotgpt.fr, it generates technical texts, reports, marketing content, policy summaries and RGPD legal documents. No account required, speeding up customer support creation. Expert verification required.

Intuitive interface for non-technical users. Account manager writes personalized answers in seconds for life insurance, respecting confidentiality and regulations.

Highlights and practical applications

Generates slogans, detailed FAQs, sales proposals and contract summaries. Creates training materials, customized e-mails and comprehensive analysis reports. Speed and precision in French optimize productivity and industry quality.

Yiaho: free French artificial intelligence

What is Yiaho?

Yiaho is afree and unlimited artificial intelligence platform, entirely in French. No registration or collection of personal data is required.

It generates images, photos or logos from text descriptions. Its intuitive interface is perfect for beginners.

Facilitating the creation of personalized visuals without technical skills, this service meets the needs of demanding professionals.

Benefits of image-generating AI for businesses

Banks take advantage of Yiaho to optimize their internal communications. Royalty-free image generation eliminates image bank costs.

Teams gain in productivity by automating visual creation. Personalized media improve message clarity and engagement.

There are no hidden costs associated with this solution. Banks gain in responsiveness thanks to visuals created in a matter of minutes.

Customized brackets enable rapid adaptation to changing needs. No initial investment is required.

Comparison table and selection guide

Functionality summary

In a professional environment, the right AI tool optimizes productivity. Free AI, accessible without registration, simplifies complex tasks with no hidden costs.

| AI Tool | Main function | Ideal for… | Accessibility (Registration) | Main limit |

|---|---|---|---|---|

| Nation AI | Versatile conversationalist | Complex writing and analysis | Direct access without registration | May require precise prompts |

| Chatbot GPT | Text generation | Rapid writing and brainstorming | Direct access without registration | Less efficient for deep analysis |

| Yiaho | Image generation | Creation of personalized visuals | Direct access without registration | Quality depends on prompt |

How do you choose the right free AI for your needs?

Nation AI excels in financial analysis and strategic document drafting (reports, contracts), with banking compliance and enhanced security. Chatbot GPT quickly generates marketing content, customer responses and advertisements. Yiaho creates logos, illustrations and YouTube thumbnails. Quality depends on prompt.

- Versatility and analysis: AI Nation for detailed reports, clear structure and compliance.

- Text speed: Chatbot GPT for emails, LinkedIn posts and brainstorming.

- Visual creativity: Yiaho for visual marketing without skills.

No hidden costs. Choose the right tool to optimize efficiency and ROI.

Reliability, safety and best operating practices

Reliability of information and limitations of free models

Free AIs present hallucinations: incorrect answers (e.g. invented Tesla figures, non-existent laws). In the banking sector, an error in a financial report can lead to major losses or regulatory sanctions. The best AIs do not replace human verification for critical decisions.

Trust in artificial intelligence must always be tempered by human vigilance. AI is an assistant, not an oracle: always check critical facts.

Hallucinations come from biased data or over-fitting. In 2023, a law firm submitted invented court decisions to a judge, illustrating the legal risks involved. These errors underline the need to systematically validate information before professional use, especially in a strict context such as finance.

Data security and ethical considerations

Never submit sensitive data (account numbers, transaction histories, customer information) to free AIs. They often store inputs to improve their models, exposing your data to leaks or misuse.

Prompt injection attacks allow cybercriminals toexfiltrate confidential data. The RGPD imposes fines of up to 4% of turnover in the event of a breach. Avoid any input of sensitive information on unsecured public platforms.

Choose secure in-house tools with data encryption and restricted access. Even with privacy settings, public platforms do not guarantee total protection. Use multi-factor authentication and regularly review privacy policies to stay compliant with banking standards.

Optimizing results: the importance of promptness

The quality of answers depends on the clarity of prompts. Vague wording leads to irrelevant results, which is critical for tasks such as risk analysis or financial reporting.

- Be specific: Specify a role (e.g. ‘Regulatory Finance Expert’) and field of application for answers aligned with industry requirements.

- Define the format: ask for a table, bulleted list or structured paragraph for a clear presentation that can be integrated into official documents.

- Iterate: Refine answers by asking for clarifications or improvements step by step, ensuring accuracy and compliance with professional standards.

To find out more, consult our complete guide to effective promptswith concrete examples tailored to the needs of banking and insurance professionals.

Integrating free AI into your digital strategy: assessment and prospects

| Tool | Main features | Limitations |

|---|---|---|

| AI Nation | No-code platform for creating GPT agents dedicated to banking. Integrates CRM, ERP and AML automation. | Initial configuration required. |

| Chatbot GPT | Text generation, data analysis and coding. Free version with daily limits. | Restricted access to advanced models such as GPT-5. |

| Google Gemini | Multimodal model for text and images. Assisted search and integration with Google services. | Less suited to specific banking business processes. |

Automating AML processes is crucial for banking security. These free tools Nation AI, Chatbot GPT and Google Gemini cover complementary needs. Nation AI optimizes business automation. Chatbot GPT facilitates authoring and analysis. Google Gemini enables visual creation and precise search.

A measured approach is essential. AI should complement human expertise, not replace it. Adopt these tools to optimize your workflows while maintaining safety and regulatory compliance.

The free AI tools Nation AI, Chatbot GPT and Yiaho meet the complementary needs of analysis, copywriting and visual creation. Their strategic integration optimizes banking and insurance processes, while keeping costs under control. However, their use must remain vigilant: AI is an assistant, not a