Key takeaway: Nvidia and OpenAI unite in a historic $100 billion pact to build superintelligence infrastructure. This colossal 10-gigawatt deployment aims to realize AGI, a bold gamble that locks in critical mutual dependence while competitors sharpen their own chips to break this monopoly.

You might think tech growth is infinite, but have you truly grasped the all-or-nothing stakes between OpenAI and Nvidia? This article thoroughly analyzes the colossal $100 billion alliance targeting superintelligence, an outsized project that could become the ultimate economic engine or the chip giant’s Achilles’ heel. Prepare to have your beliefs challenged by concrete facts and a fresh perspective on financial dangers most investors prefer to ignore.

The OpenAI-Nvidia Alliance: A $100 Billion Pact for AGI

The Deal of the Century for AI Infrastructure

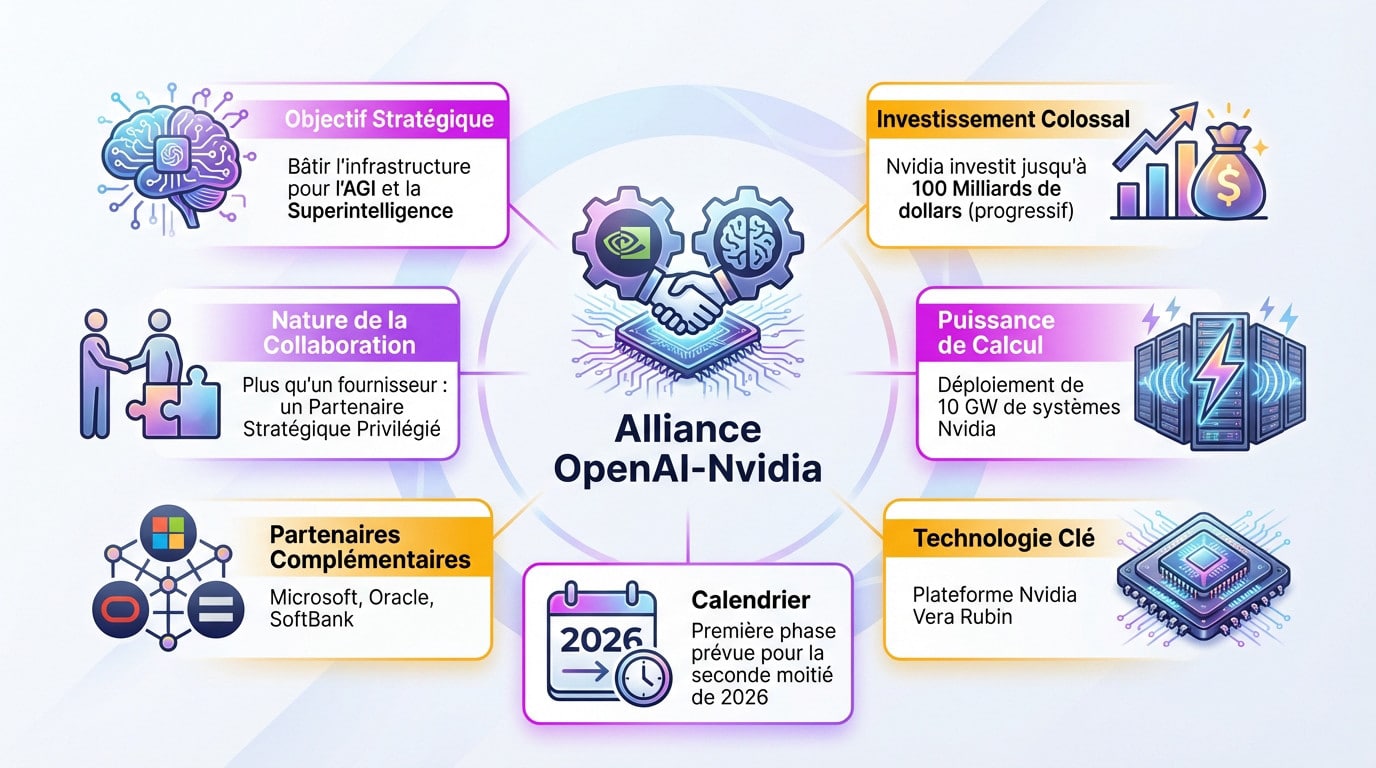

Forget simple commercial agreements. OpenAI and Nvidia are partnering to build the colossal infrastructure needed for the next AI models. This is a historic pact that redefines the rules of the technological game.

Brace yourselves: the plan involves the deployment of 10 gigawatts of Nvidia systems. A colossal raw power, entirely dedicated to the frantic race towards superintelligence.

Nvidia will gradually inject up to $100 billion, conditioned on each commissioning. The first phase begins in 2026 with the Vera Rubin platform. A daring gamble for the entity behind what you need to know about OpenAI.

More Than a Supplier, a Strategic Partner

Nvidia isn’t just a chip vendor in this story. It is now a privileged strategic partner for OpenAI. Their collaboration goes far beyond mere computer hardware.

Here are the raw data cementing the future trio of OpenAI, AGI, and Nvidia:

| Aspect | Details |

|---|---|

| Computing Power | Deployment of 10 GW of Nvidia systems |

| Investment | Up to $100 billion invested by Nvidia |

| Key Technology | Nvidia Vera Rubin Platform |

| Timeline | First phase planned for the second half of 2026 |

| Complementary Partners | Microsoft, Oracle, SoftBank |

Superintelligence as Fuel: Why Such Excess?

After seeing the scale of the deal, one might wonder what justifies such grandiosity. The answer lies in three letters: AGI.

AGI, a Monster That Devours Computing Power

Let’s clarify one point: Artificial General Intelligence (AGI) isn’t just a smarter chatbot. It’s an AI with human cognitive abilities, and its development demands absolutely phenomenal computing power.

OpenAI’s admission that AGI is imminent is the true driver of this historic agreement. The ambition to reach this level of intelligence is directly proportional to the available computing resources.

The training of future models, far more complex than GPT-4, explains this insatiable need for Nvidia GPUs. The OpenAI AGI Nvidia dynamic then becomes a matter of survival.

The Words of the Titans: A Shared Vision

Let’s hear from Sam Altman and Jensen Huang, because they don’t speak the usual corporate jargon. They share a radical common vision on the vital importance of computing infrastructure.

Computing infrastructure is the foundation of the future economy. We will use what we build with NVIDIA to achieve breakthroughs in AI and scale them.

For Altman, it’s not about technology, but about building the foundations of tomorrow’s economy. An ambition that justifies the investment, however heavy it may be.

As for Jensen Huang, he calls this the “next big leap forward.” This proves that Nvidia positions itself not just as a mere supplier, but as a central player in this new era.

Nvidia, the Strong Link… or the Achilles’ Heel?

Dependence, a Double-Edged Sword

Nvidia is currently cashing colossal checks. But the OpenAI AGI Nvidia equation remains a risky gamble. This extreme dependence on a single client resembles a casino game.

Here are the risks for Nvidia that make me wary:

- Financial Vulnerability: OpenAI is burning cash at an alarming rate, with astronomical operational costs threatening its solvency.

- Technological Gamble: Everything hinges on the success of the AGI quest; a technical failure would halt orders immediately.

- Planned Infidelity: OpenAI is already flirting with Broadcom and AMD to diversify its suppliers and reduce Nvidia’s grip.

Signals Worrying Analysts

Some financial experts are sounding the alarm about this partnership. The scale of the deal might be masking immense financial pressure on the startup. That’s why some daring individuals are now taking a short position on NVDA.

The high cost of OpenAI’s operations requires a counterbalance. This latest move could halt Nvidia’s growth if OpenAI’s strategy doesn’t pay off.

OpenAI appears to be financially cornered. Nvidia finds itself caught in this infernal spiral. One is entitled to ask: is this a growth partnership or a disguised bailout?

Before investing in AI, always ask yourself how to assess the real risk behind these announcements.

The End of the Monopoly? Competition Organizes in the Shadows

And as if this internal risk weren’t enough, an external threat is growing. Nvidia’s monopoly on AI hardware might well be coming to an end.

Google, Amazon, Meta: The Counterattack of “In-House” Chips

Nvidia has an obvious strategic blind spot. Do you really think other tech giants will sit idly by and pay the bill? Absolutely not. They are actively developing their own chips to break this costly dependence.

- Google and its TPUs (Tensor Processing Units): a mature technology, already in its seventh generation, which is now establishing itself as a technically and commercially viable alternative to classic GPUs.

- Amazon with its Trainium and Inferentia chips: designed specifically for training and inference in the AWS cloud, the Trainium 3 chip already allows for reducing training costs by nearly 50%.

- Meta and its own line of AI chips: Zuckerberg is deploying his MTIA accelerator to power its internal models, thereby mechanically reducing its dependence on external suppliers.

Towards the Commoditization of Computing? The Real Danger for Nvidia

If these alternative chips flood the market, the consequence is inevitable: computing power will become “commoditized”. This is the real danger. Computing would become a commonplace resource, as standard as the electricity coming out of your outlet.

This shift would signal the abrupt end of the “Nvidia tax”. The company would no longer be able to dictate its exorbitant prices thanks to its near-monopoly position. Nvidia’s outrageous profitability would then be directly threatened by this price war.

Even if the OpenAI AGI Nvidia gamble seems solid for now, this underlying trend could force them to pivot. One only needs to observe alternatives like Gemini to understand that the future of computing won’t necessarily be monochrome.

The $100 billion alliance between OpenAI and Nvidia is a titanic gamble on the future of AGI. Between outsized ambition and financial risks, this duo is going all-in against hungry competition. It remains to be seen if this marriage will stand the test of time. One thing is certain: the race for superintelligence, and it promises to be intense!