The essential takeaway: Profitable AI investment requires looking beyond the hype to understand the full value chain, from hardware infrastructure to software platforms. Distinguishing companies with genuine proprietary data from those simply “AI-washing” allows for a balanced strategy that mitigates volatility. True opportunity lies in finding concrete intellectual property and real-world utility, rather than chasing every fleeting marketing buzzword.

Does the frenzy surrounding investing in ai leave you paralyzed between the fear of missing out and the terror of a bursting bubble? We strip away the hype to reveal the actual value chain, showing you exactly how to distinguish genuine technological leaders. You are about to uncover the specific strategies and overlooked market layers that allow smart investors to build wealth without gambling their savings.

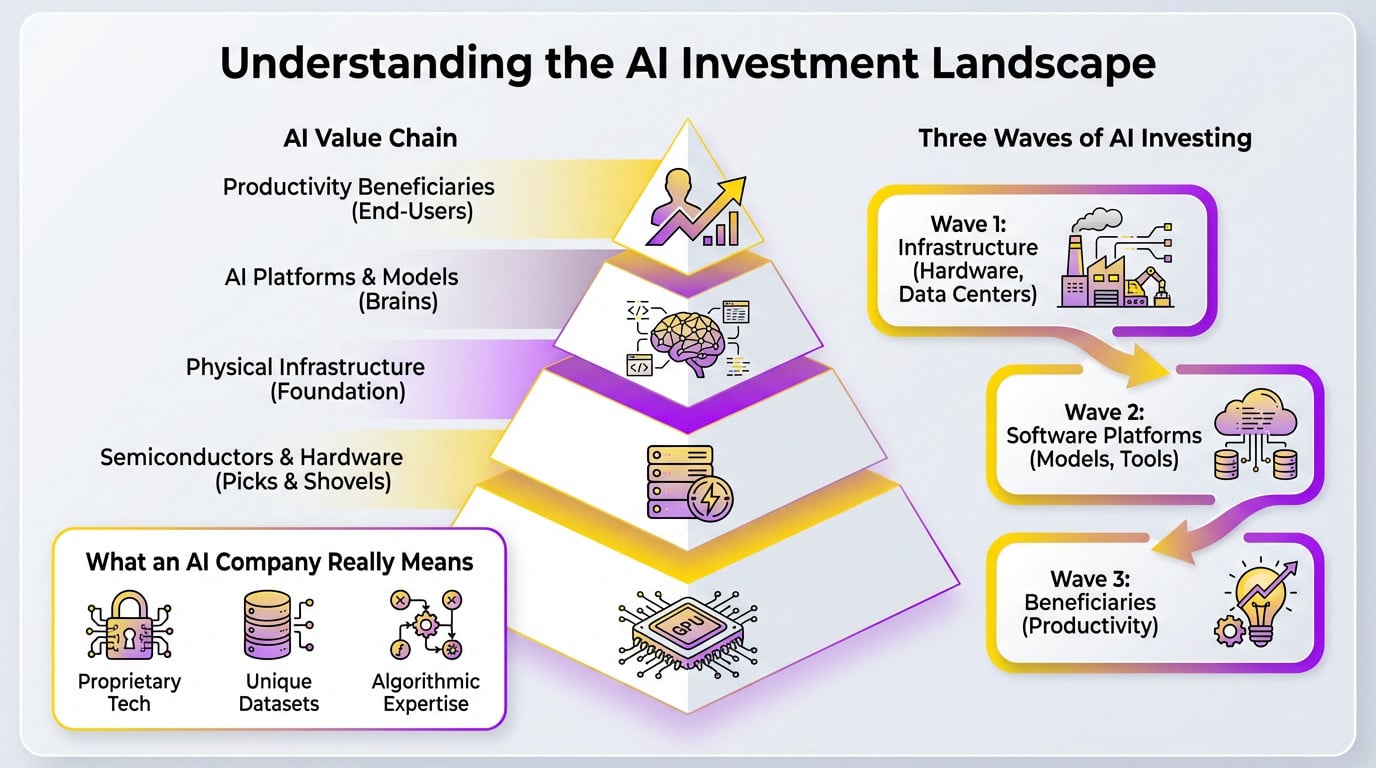

Understanding the AI Investment Landscape

Beyond the Big Names: The AI Value Chain

Most people think investing in ai just means buying stock in giants like Nvidia or OpenAI. That is a massive oversimplification of a complex value chain. You need to understand the specific layers to place your capital intelligently.

Money actually moves through distinct phases in this sector. It starts with the heavy infrastructure, flows into platforms, and finally reaches the applications we use.

Here is how the money breaks down across the four main layers:

- The picks and shovels: Semiconductors and hardware (GPUs, TPUs).

- The foundation: Physical infrastructure (data centers, energy grids).

- The brains: AI platforms and models (like those from the team behind the creation of ChatGPT).

- The end-users: Productivity beneficiaries (companies integrating AI into their services).

The Three Waves of AI Investing

The first wave is already crashing over us: infrastructure. This represents the heavy hardware, specifically the chip manufacturers and the data center builders. It is the absolute base of the pyramid, though valuations here are already getting quite steep.

Next comes the second wave: software platforms. These are the companies building the models and the tools that everyone else will eventually build upon. It is a crowded room right now.

Finally, look at the third wave: the beneficiaries. These are companies across all sectors using AI to boost productivity.

What an ‘AI Company’ Really Means

Be careful, because “AI-washing” is everywhere in the market right now. Too many companies slap “AI” onto their marketing materials without having any real technical substance underneath. You have to learn to spot the difference before writing a check.

A legitimate AI company usually owns proprietary technology, unique datasets, or specific algorithmic expertise. That is where the real competitive advantage lives, especially for the future AI agents that will require robust, proven technology to function correctly.

Direct vs. Indirect Exposure: Choosing Your Path

Now that you understand the playing field, the question is: how do you get in? There are two main entry doors.

The High-Risk, High-Reward of Individual Stocks

You pick a specific winner, like a chip giant or a promising startup. It is the most straightforward method on paper. You simply buy shares of the company you believe in.

But here is the catch: investing in ai this way is volatile. Picking the wrong horse burns cash fast. Yet, if you do your homework, the potential gains are unmatched. It is a game for those who love deep research.

ETFs and Funds: The Power of Diversification

Think of ETFs as buying a whole basket of AI stocks at once. You get exposure to semiconductors, software, and infrastructure in a single transaction. It is a much broader approach than betting on one name.

The main perk here is simple: risk reduction. If one company in that basket crashes, the others can pick up the slack. It is the smarter play if you believe in the sector but hate betting on single actors.

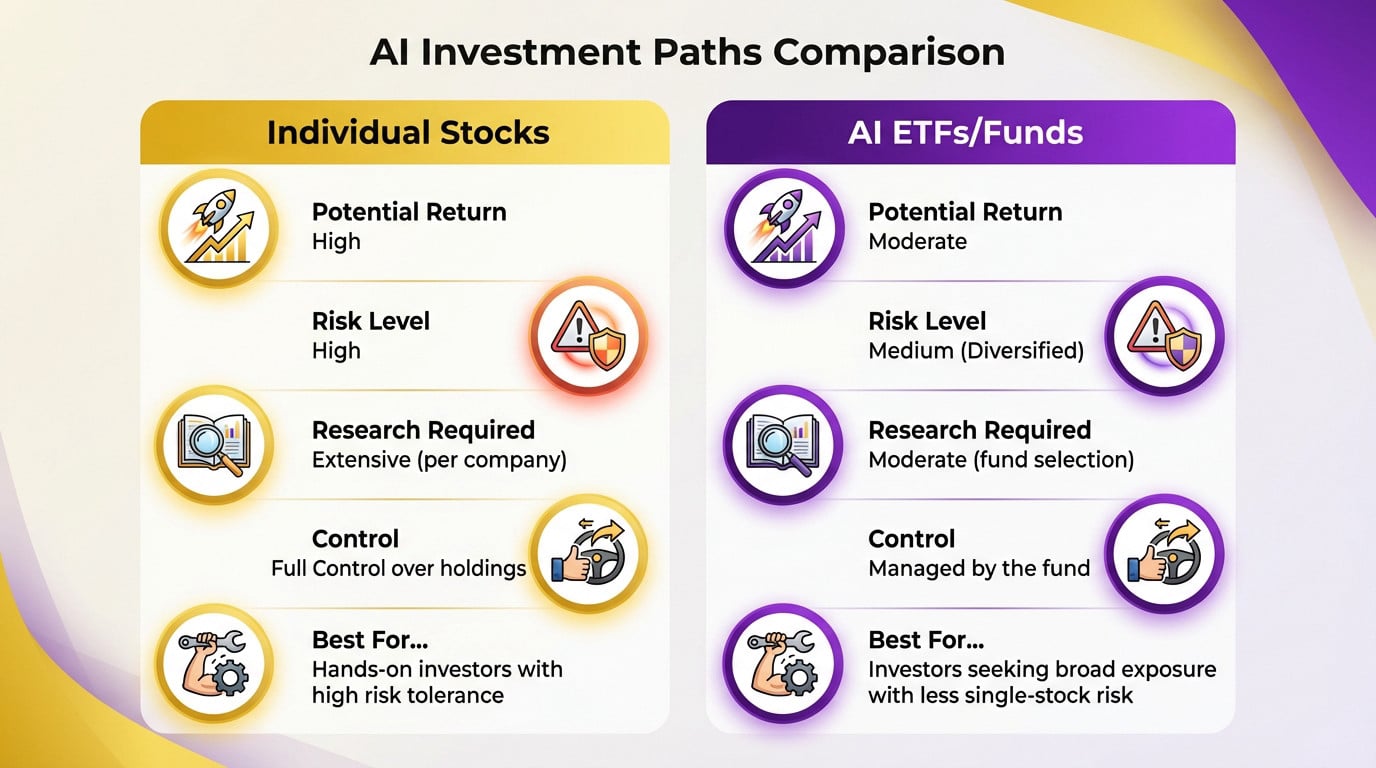

A Practical Comparison

To clear up the confusion, let’s look at a direct comparison. Here are the hard facts you need to weigh.

| Feature | Individual Stocks | AI ETFs/Funds |

|---|---|---|

| Potential Return | High | Moderate |

| Risk Level | High | Medium (diversified) |

| Research Required | Extensive (per company) | Moderate (fund selection) |

| Control | Full control over holdings | Managed by the fund |

| Best for… | Hands-on investors with high risk tolerance | Investors seeking broad exposure with less single-stock risk |

How to Spot a Promising AI Venture

Whether you pick individual stocks or funds, the quality of the underlying asset is the only thing that matters. So, how do we separate the wheat from the chaff?

The Three Pillars of a Solid AI Company

You need to filter out the noise immediately. I always look for three non-negotiable fundamentals before putting a dime down. Without these, the startup is just smoke and mirrors.

Here is the checklist that separates the winners from the hype. Investing in AI demands scrutiny of these specific assets.

- Data Mastery: Does it own proprietary, clean, and relevant data? This is the fuel for any great AI.

- Team Quality: Is the team a mix of top-tier algorithm experts and people who deeply understand the market they’re serving?

- Real-World Fit: Does the technology solve a concrete, valuable problem, or is it just a cool tech demo?

Look for the Moat: Proprietary Tech and IP

Intellectual property stands as the only true defense. Companies simply wrapping open-source APIs possess zero barriers to entry. You must hunt for specific patents or unique model architectures. If they lack distinct algorithms, your capital is exposed.

Don’t be fooled by a shiny exterior.

Many companies now slap an ‘AI’ label on their products, but true value lies in proprietary data and algorithms that solve a real-world problem, not just a slick interface.

Understanding Financing Mechanisms

You need to understand who else is backing the horse. Smart money usually follows reputable venture capital or corporate venture funds. Their presence acts as a strong signal of due diligence. Business angels also play a role early on.

Do not ignore public backing mechanisms either. In ecosystems like France, Bpifrance supports deeptech projects significantly. This external validation reduces your initial risk exposure. It proves the tech has passed serious expert review.

Building a Prudent AI Investment Strategy

Identifying the right targets is one thing. Building an investment strategy that is coherent and lets you sleep at night is another.

Start with a Plan, Not a Stock Tip

Before chasing the next big tech stock, ask yourself what you actually want to achieve. Are you looking for quick gains or long-term growth over a decade? Your specific risk tolerance dictates every move you make here.

AI shouldn’t be your whole portfolio, just a calculated slice of it. Experts often suggest capping high-risk sectors like this to 5-10%. This keeps you in the game without exposing your life savings to a tech bubble burst. It’s about balance.

Using AI Tools to Invest… in AI?

It sounds a bit meta, but you can actually use robo-advisors to help manage your strategy. These algorithms crunch massive amounts of financial data faster than any human analyst ever could. They spot trends in milliseconds. It’s a powerful edge for retail investors.

But here is the trap: these tools are helpers, not prophets. Never follow an algorithm blindly just because it looks sophisticated. You need your own critical thinking to spot marketing hype or glitches. If a machine promises easy money, run away.

The Practical Steps to Your First Investment

Ready to pull the trigger on investing in ai? First, do your due diligence on the specific ETF or stock. Open a brokerage account, fund it, and simply place your buy order. It really is that mechanical once the research is done.

Please, do not bet the farm on day one. Start with a small amount to get a feel for the market’s wild swings. You can always scale up later. This approach protects your capital while you learn the ropes.

Managing the Real Risks: Beyond the Hype Cycle

The enthusiasm is palpable, but smart investing demands a healthy dose of skepticism. Let’s talk about the real dangers hiding behind the headlines.

Technological and Data-Related Pitfalls

Let’s be real: AI models are just mirrors of their training data. If that input is biased, obsolete, or just plain wrong, the output is worthless. It’s a classic trap.

You need to watch out for specific red flags before investing in ai. Here is what keeps me up at night regarding these tech ventures:

- Data Reliability: Garbage in, garbage out. The AI is only as good as its data.

- Marketing Confusion: Distinguishing true AI.

- Security Flaws: AI systems can be vulnerable to new kinds of attacks and data breaches.

- Scams: Be wary of promises of guaranteed high returns, a classic red flag for fraud.

The Looming Shadow of Regulation

The AI sector is currently a regulatory Wild West. Governments globally are barely starting to draft the rules, like the EU’s AI Act. This makes regulatory risk massive and totally unpredictable for your portfolio. We are flying blind here.

“Investing in AI today is also a bet on the future regulatory framework. A single new law on data privacy or algorithmic bias can completely change a company’s prospects overnight.”

Ethical Concerns and Malicious Use

We can’t ignore the messy ethical stuff like algorithmic bias, job displacement, or mass surveillance. Companies ignoring these issues face massive reputation damage and inevitable lawsuits. It’s not just about morals; it’s about protecting your capital.

Then there is the dark side of the tech. Tools like Dark GPT prove that threats on the dark web are real and dangerous. These malicious uses could trigger harsh crackdowns that impact the entire industry.

Investing in AI isn’t a magic get-rich-quick scheme; it’s a marathon through a complex, evolving landscape. Whether you pick individual stocks or diversified ETFs, success relies on rigorous research and a healthy dose of skepticism. Embrace the technology, but keep your wits about you—after all, even the smartest algorithm can’t replace your common sense.