The essential takeaway: AI arbitrage transforms service models by utilizing accessible automation tools to produce high-value expert outcomes. This strategy enables agencies to break the time-for-money trap, scaling profits through operational efficiency rather than increased headcount. Success relies on bridging the gap between low-cost technology and premium business solutions, not financial speculation.

Still trying to figure out how to monetize those chatbots without becoming a software engineer? We have ai arbitrage explained simply: it is the art of flipping cheap digital labor into high-value client solutions. You will discover how to secure those sweet profit margins while everyone else is just playing with prompts.

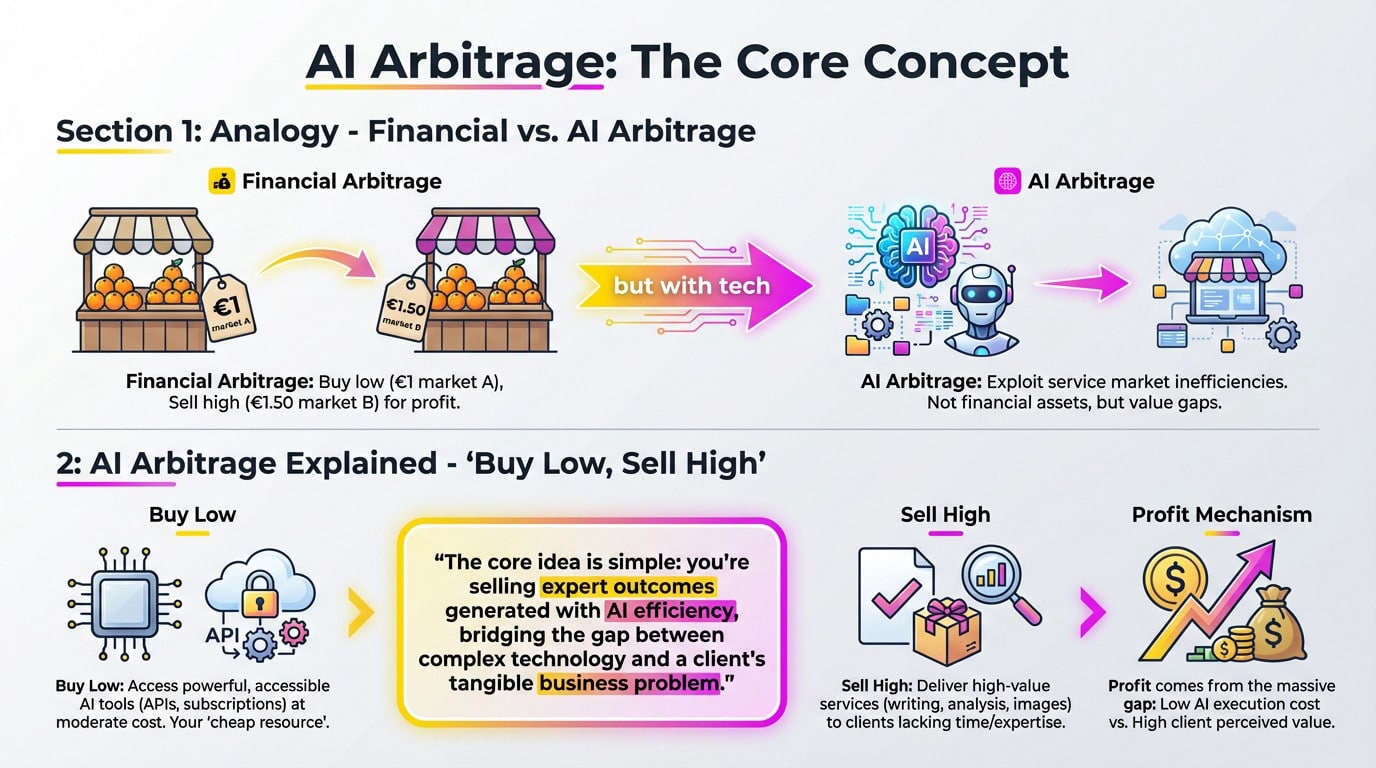

Demystifying AI Arbitrage: The Core Concept

Most people get hung up on tech, but look at the economics first. We need to strip away buzzwords and examine a mechanism Wall Street has used for decades.

It’s Just Like Financial Arbitrage, But With Tech

Financial arbitrage is simply spotting a price difference for the same asset across markets to lock in a risk-free profit. Think of buying oranges for $1 at a local stall and selling them for $1.50 across town. You pocket the difference without the gamble.

Now, apply that logic digitally. AI arbitrage explained isn’t about trading stocks; it involves exploiting massive inefficiencies in the service market. You aren’t moving goods, but capitalizing on a stark gap in value delivery.

Here is the kicker. AI becomes the lever to exploit these discrepancies at a speed and scale no human team could match. That velocity is exactly where the opportunity hides.

The ‘Buy Low, Sell High’ of AI Services

Consider the “buy low” component. You access powerful AI tools—often via cheap subscriptions or APIs—that perform heavy lifting for pennies. These platforms are your low-cost resource, available 24/7.

Then comes the “sell high.” You provide high-end services—data analysis, writing, or visuals—to clients lacking the time or skill to use these tools. They pay for the solution, not the method.

The core idea is simple: you’re selling expert outcomes generated with AI efficiency, bridging the gap between complex technology and a client’s tangible business problem.

Profit lives in that disconnect. You pay for low-cost algorithmic execution, while the client pays for the high perceived value of the result. It is an efficiency gap traditional workflows cannot close.

How the AI Arbitrage Model Works in Practice

You want ai arbitrage explained in the real world? It isn’t just theory; it is about turning a concept into a ruthless business model for service agencies.

The Rise of the AI-Powered Agency

Traditional agencies are sweating bullets. Their billing model based on hours is collapsing under automation. Why pay for a week of manual work when a script does it in minutes? The old way is obsolete.

The arbitrage agency flips the script, selling outcomes rather than time. They produce high-level strategy and content faster and cheaper. The rule is simple: if a machine can do it, a human shouldn’t.

Automation handles the grunt work. This frees up your experts to focus purely on strategy, client relationships, and strict quality control. That is where the real value lives.

Key Components of the Machine

A simple subscription doesn’t make you an arbitrageur; you need a system. Without architecture, you are just typing prompts into a void. Several elements must connect to make this viable:

- AI Tools: The engine of the operation (e.g., large language models, image generators).

- Human Expertise: The pilot who configures tools and refines outputs for client goals.

- Streamlined Workflow: A clear process for processing requests and delivering polished products.

The magic lies in orchestration. You can configure specialized AI agents to execute complex task sequences, boosting efficiency far beyond simple automation.

Service arbitrage vs. ai trading: don’t confuse them

The term “arbitrage” gets thrown around loosely, often conjuring images of Wall Street floors, but we need to draw a hard line here. You are either trading assets or you are optimizing labor; mixing these up is a rookie mistake.

One is about process, the other is about price

Financial AI arbitrage uses complex algorithms to exploit micro-price differences across exchanges in mere milliseconds. It is a high-speed game of pure volume and math. You aren’t fixing a problem; you are capitalizing on market lag. It’s strictly financial.

Service arbitrage, however, targets a glaring process inefficiency. You replace slow, expensive human labor with fast, cost-effective AI workflows. The profit margin comes directly from operational efficiency. This is ai arbitrage explained simply: use tech to fix broken workflows.

A side-by-side breakdown

To make this distinction perfectly clear, look at this direct comparison. These differences are fundamental to your strategy.

| Feature | AI Service Arbitrage | AI Financial Arbitrage |

|---|---|---|

| Goal | Deliver expert services (content, analysis) more efficiently. | Exploit temporary price differences of financial assets. |

| Core Asset | Human expertise augmented by AI tools. | Capital and high-speed trading algorithms. |

| Source of Profit | Margin between low operational cost and high-value service price. | Tiny price discrepancies multiplied by large trading volumes. |

| Key Skill | Process design, client management, and prompt engineering. | Quantitative analysis, market micro-structure knowledge, and low-latency programming. |

| Risk Profile | Operational risks (quality control, tool dependency). | Market risks (volatility, execution failure, algorithm errors). |

Building on Arbitrage: Key Considerations and Risks

The concept sounds seductive, doesn’t it? But turning that spark into a viable business requires strategy and a healthy fear of potential traps.

Finding Your Niche Is Everything

Trying to do everything is the fastest route to failure. The market is too vast. Specialization is the only viable path forward.

You need a painful, specific gap to exploit. Here is what ai arbitrage explained looks like in the real world:

- Hyper-specific content creation: (e.g., social media posts for dentists).

- Automated data analysis: (e.g., weekly sales reports for e-commerce stores).

- Specialized image generation: (e.g., product mockups for startups).

Aim to become the obvious solution for a specific problem. That is where you find the best margins and the least ferocious competition.

The Hidden Risks You Can’t Ignore

This isn’t a risk-free cash machine. Over-reliance on third-party tools is a major danger. If an API changes or crashes, your business is instantly paralyzed.

Your value isn’t just using the AI tool; it’s the human-led quality control that prevents embarrassing errors and AI “hallucinations” from reaching your client.

Quality can be uneven. AI’s “good enough” is rarely sufficient for a client paying full price. Human oversight remains indispensable.

Finally, this model differs from investing in AI technology itself. You are betting on your ability to apply the technology, not on the tech itself.

Ultimately, AI arbitrage is the art of turning raw computing power into tangible business value. It’s not about building the robot; it’s about teaching it to dance for your clients. By mastering this gap between technology and expertise, you secure your agency’s future—leaving the outdated “billable hours” model in the digital dust.