Key takeaway: Google and Klarna are enforcing UCP and AP2 protocols to finally standardize AI agent payments. This technological breakthrough eliminates costly integrations, ensuring smooth and secure autonomous transactions throughout the entire purchase cycle. Machine-to-machine commerce becomes an operational, scalable, and immediately accessible reality.

Are your AI agents still hindered by fragmented payment systems that limit your sales opportunities? Klarna partners with Google’s power to enforce the Universal Commerce Protocol, a radical solution that removes technical friction and liberates financial autonomy. Discover now how this unprecedented standardization will secure your machine-to-machine transactions and boost the efficiency of your commercial ecosystem.

Standardizing AI Agent Payments: No More Silos

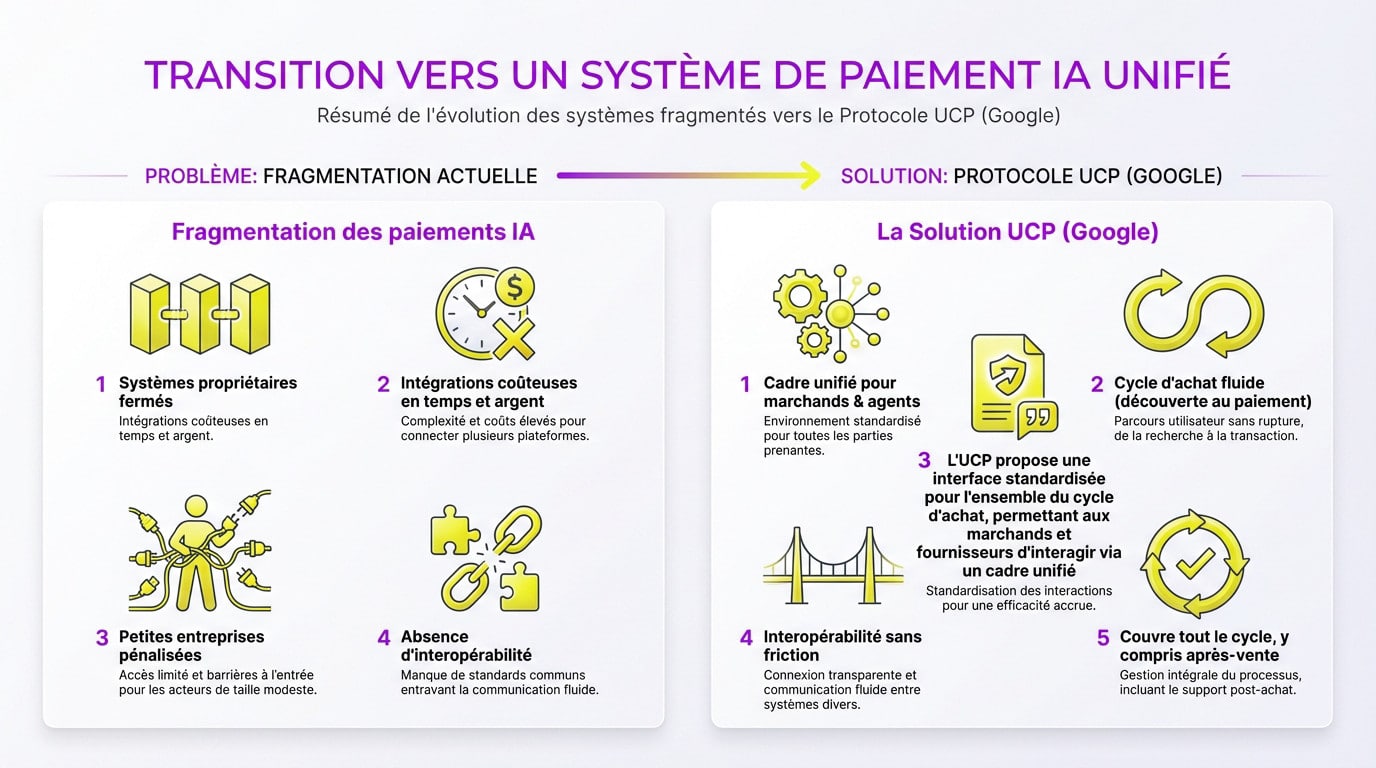

After the rise of autonomous agents, technical fragmentation still hinders their adoption. To address this, Swedish fintech Klarna supports Google’s Universal Commerce Protocol (UCP) and Agent Payment Protocol (AP2), open standards aimed at resolving the lack of payment interoperability for conversational AI agents and standardizing automated commerce.

Ending Costly Proprietary Integrations

Let’s be frank: every merchant today is locked into their own closed system. This forces AI developers to create custom bridges for each connection. It’s a brutal brake on innovation.

This fragmentation costs you dearly in time and money. Current ecosystems resemble walled gardens. Without a real standard, interoperability remains impossible. We must break down these technical barriers now.

Small businesses suffer the most from this complexity. They simply cannot afford multiple integrations.

UCP: A Unified Framework for the Entire Purchase Cycle

Google unveils the Universal Commerce Protocol as the ideal solution. This framework standardizes exchanges between merchants and agents. Everything becomes fluid, from discovery to final payment.

UCP offers a standardized interface for the entire purchase cycle, allowing merchants and providers to interact via a unified framework.

Thanks to this interoperability, conversational agents navigate everywhere seamlessly. It’s a radical change for modern commercial architecture.

After-sales support also directly benefits from this structure. The entire purchase cycle is finally covered.

Native Integration: Klarna’s Head Start

While Google lays the foundations with UCP, players like Klarna are already seizing these tools to make it a success.

Payment Flexibility Without Specific Logic

Klarna uses the Agent Payment Protocol (AP2) to simplify flows. Deferred payment options are natively integrated. The AI agent decides in real-time based on the user’s profile.

This is the whole point of agentic AI, definition and operation included. You understand why this autonomy changes everything.

This approach eliminates the need to code payment logic for each platform. The system becomes universal and agile. Agents act with complete and secure financial autonomy.

Responsiveness is key here. Transactions are validated in mere milliseconds.

Massive Reduction in Merchant Technical Debt

Adopting these standards drastically reduces technical debt. Merchants no longer have to maintain dozens of different APIs. A single integration layer is enough to reach all agents. This is a monumental gain in operational efficiency for IT teams.

Tools like Nation AI directly benefit from this simplification. Deployment for partners becomes child’s play.

Visualize the immediate performance gain. Moving from obsolete silos to a unified method radically transforms management.

| Criterion | Old Method (Silos) | New Method (UCP/AP2) |

|---|---|---|

| Integration Cost | High | Low |

| Deployment Time | Weeks | Days |

| Interoperability | Low | High |

| Maintenance | Complex | Simplified |

Security: How to Secure Funds Managed by AI?

Managing KYC and AML Compliance for Agents

The autonomous management of your funds requires full compliance with KYC rules. Your AI agents must possess a verifiable legal identity. The fight against money laundering remains our absolute priority.

To successfully integrate these technologies, consult our guide on adopting agentic AI in business. It’s essential.

We impose strict control mechanisms to block any attempt at fraud. AI-driven financial accounts require firm spending limits. Human oversight remains necessary.

The security of your banking data is paramount. No compromise is tolerated here.

Transparency and Hygiene of Decision Data

The decision logic must remain clear for every user. Why did the AI select this specific product? This transparency strengthens your trust in automated financial transactions.

Rigorous data hygiene is essential for UCP. This is why Swedish fintech Klarna supports Google’s Universal Commerce Protocol (UCP) and AP2. Merchants must guarantee the quality of their catalogs. This is the foundation of healthy commerce.

To guarantee security, we require concrete proof. Here are the technical standards you absolutely must adopt now:

- Need for clear transactional logs

- User validation for large amounts

- Auditability of choice algorithms

Economy 2.0: The Advent of Autonomous Transactions

Beyond technology and security, our entire economic model is shifting towards a new paradigm. It is in this context that Swedish fintech Klarna supports Google’s Universal Commerce Protocol (UCP) and Agent Payment Protocol (AP2), open standards aimed at resolving the lack of payment interoperability for conversational AI agents and standardizing automated commerce.

Crypto as a Machine-to-Machine Payment Rail

Digital assets are emerging as the ideal solution for exchanges. AI-to-AI transactions demand a speed that fiat doesn’t always offer. Crypto is natively programmable.

The emergence of cryptocurrency as an AI-to-AI transaction rail promises unprecedented efficiency and speed.

Traditional rails struggle against the flexibility of smart contracts. These automate contractual clauses without intermediaries. Overall market efficiency is greatly improved for everyone.

Micro-payments finally become profitable. This opens up entirely new monetization opportunities.

New Monetization Models and Virtual Cards

Autonomous purchasing transforms traditional economic models. The use of temporary virtual cards secures each transaction. Financial services are now integrated directly into the core code of agents.

The concept of a human market for AI is striking. Agents can now recruit humans for physical tasks. This completely reverses the usual work relationship. It’s a silent transformation that redefines the value of human labor.

These new methods redefine value exchange:

- Issuance of single-use cards

- Task-based micro-services

- Algorithm-managed subscriptions

The era of autonomous commerce has begun! With UCP and AP2 protocols, Google and Klarna are breaking down barriers for a finally open and transparent ecosystem. Don’t miss the interoperability shift. Adopt these standards today and propel your transactions into the future. The revolution is underway: be ready to transform your business!