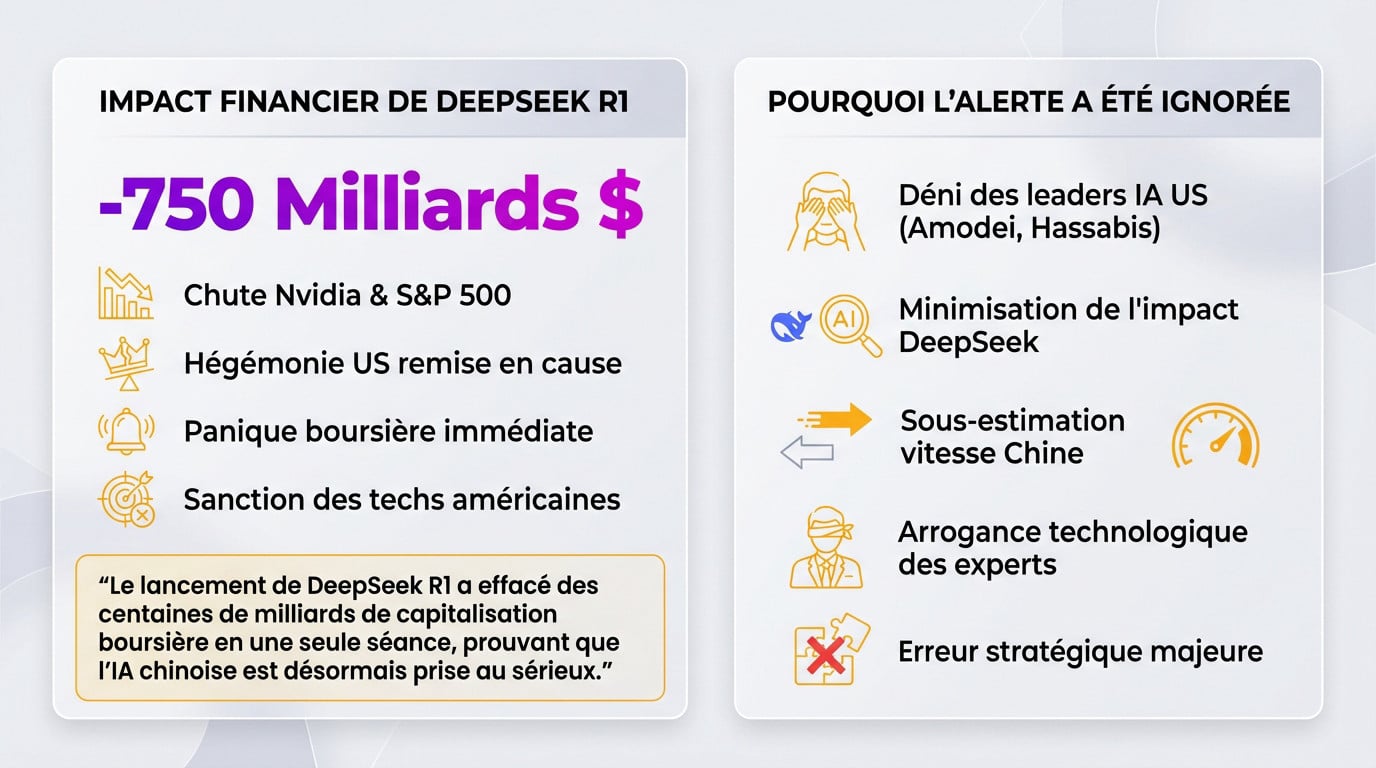

Key takeaway: The arrival of DeepSeek R1 breaks the hegemony of raw power. Chinese algorithmic efficiency becomes the new global standard, offering exceptional performance at a lower cost. This paradigm shift finally frees innovation from costly hardware constraints. The shock is historic: $750 billion evaporated from Wall Street in a single session.

Why has this analysis of Wall Street’s errors regarding Chinese AI become vital after the $750 billion financial earthquake triggered by DeepSeek R1? Our team precisely dissects the complete denial of American analysts in the face of Beijing’s radical software efficiency strategy to break Nvidia’s hegemony. Discover immediately how this low-cost technological feat redefines global industry standards and benefit from our exclusive revelations to anticipate future massive capital movements towards the most powerful open models in the current tech sector.

DeepSeek and Wall Street: The Markets’ Brutal Awakening

After months of technological euphoria, the arrival of DeepSeek R1 sent a shockwave through American finance.

A $750 Billion Financial Earthquake

Nvidia fell. The S&P 500 sank. In fact, American hegemony is faltering — $750 billion went up in smoke.

Panic was instantaneous. Markets penalized US tech in the face of the East. Nation AI offers a simplified alternative.

In short, the shock was total. Wall Street trembled.

The launch of DeepSeek R1 wiped out hundreds of billions in market capitalization in a single session, proving that Chinese AI is now taken seriously.

Why Analysts Ignored the Warning

Dario Amodei and Demis Hassabis initially downplayed DeepSeek. They thought their lead was untouchable. It was blatant denial.

Wall Street ignored the speed of the R1 model. Its $6 million cost destabilizes giants. Read our blog on monetization.

Arrogance blinded the experts. This Analysis of Wall Street’s Errors Regarding Chinese AI, focusing on DeepSeek, is enlightening.

Chinese Efficiency Defies the Hardware Race

But beyond the stock market figures, it’s the design method that radically changes the game.

The Myth of Cost-Based Scaling Collapses

Look at the numbers. American giants inject hundreds of billions into hardware. Yet, China achieves the feat with only 15%.

The scaling law is faltering. Raw power is no longer everything. Efficiency becomes the new success criterion for tomorrow’s models.

American gigantism shows its limits. Intelligence does not solely depend on the number of chips.

| Players | AI Infrastructure Investment |

|---|---|

| US Hyperscalers | > $600 billion |

| Chinese Firms | 15-20% of US budget |

Algorithmic Ingenuity Born of Constraint

Chip restrictions forced Chinese engineers to optimize code. They had to do more with less hardware. It’s innovation by constraint.

The limited hardware did not curb research. On the contrary, it stimulated it. Software performance is gaining ground.

Algorithms have become more efficient. It’s an engineering lesson. Our Analysis of Wall Street’s Errors Regarding Chinese AI, focusing on DeepSeek, highlights the impact of AI chips.

Open-Weight Models: The New Global Standard

This efficiency doesn’t remain confined to China; it spreads via open models that redefine the rules.

Mass Adoption of Qwen by US Startups

American startups are now massively integrating models like Alibaba’s Qwen. It’s a truly cost-effective solution. They benefit from formidable performance without draining their cash reserves.

Look at the rankings on Hugging Face. China dominates global open-source. Every day, thousands of developers download these powerful tools to build the future.

Borders are falling. Chinese code is being adopted everywhere, via the 10 best free AI applications.

The Decline of Closed Models Versus Open Source

American walled gardens cost a fortune in subscriptions. Yet, Chinese open-weight offers a nearly free alternative. Companies quickly do the math. Why pay a lot for less freedom?

Open source is becoming the norm. It allows for full customization. It’s a massive strategic asset.

Proprietary models are fading away. The analysis of Wall Street’s errors regarding Chinese AI, focusing on DeepSeek, shows this shift.

- Reduced Infrastructure Costs

- Data Sovereignty for Businesses

- Comparable Performance to US Proprietary Models

Nvidia’s Future Against the AI Plus Model

If software takes precedence over hardware, Nvidia’s throne could well falter sooner than expected.

Dependence on Costly Hardware Challenged

DeepSeek shakes up Nvidia’s monopoly. The Chinese approach proves that thousands of H100 GPUs can easily be done without. Naturally, investors are starting to seriously worry about their capital.

Money is now flowing towards pure algorithmic optimization. The focus is on digital sobriety rather than usual excess. This capital pivot completely redefines the current rules of the game.

Nvidia’s dominance is no longer an insurmountable barrier if software innovation allows for a tenfold reduction in chip requirements.

The tide is turning for hardware. Software intelligence is finally asserting itself.

Beijing’s Sectoral Penetration Strategy

Beijing is massively deploying its AI Plus plan. The goal is to infuse artificial intelligence into every economic sector. The Six Tigers are receiving colossal funding to carry out this national ambition.

Tencent and Alibaba support these local gems. They are building a robust ecosystem, independent of Western technologies. It’s ideal for your AI agents and our Botpress review pricing.

United China. Analysis of Wall Street’s Errors Regarding Chinese AI, focusing on DeepSeek.

The era of software efficiency is here. The DeepSeek earthquake proves that innovation doesn’t wait. Do you want to stay ahead? We’ll help you navigate this new global paradigm. Adopt the best strategies now. Propel your vision with our expertise. The future of AI is written with us!