Key takeaway: Yuval Noah Harari is less concerned about job losses than a global financial crisis driven by artificial intelligence. This technology could generate financial products so complex that they would become impossible to regulate, far surpassing the 2008 scenario. This systemic risk threatens global stability, potentially even triggering very real wars.

While we all fear a robot taking our job, an AI financial crisis of unprecedented violence may already be looming silently on the horizon. Yuval Noah Harari identifies very real threats here, where algorithms generate stock market products so complex that they become completely impossible for ordinary people to master. Hold on tight, because we’re going to dissect how this technological “black box” could transform our societies into a global chaos that even the 2008 crisis didn’t dare to imagine.

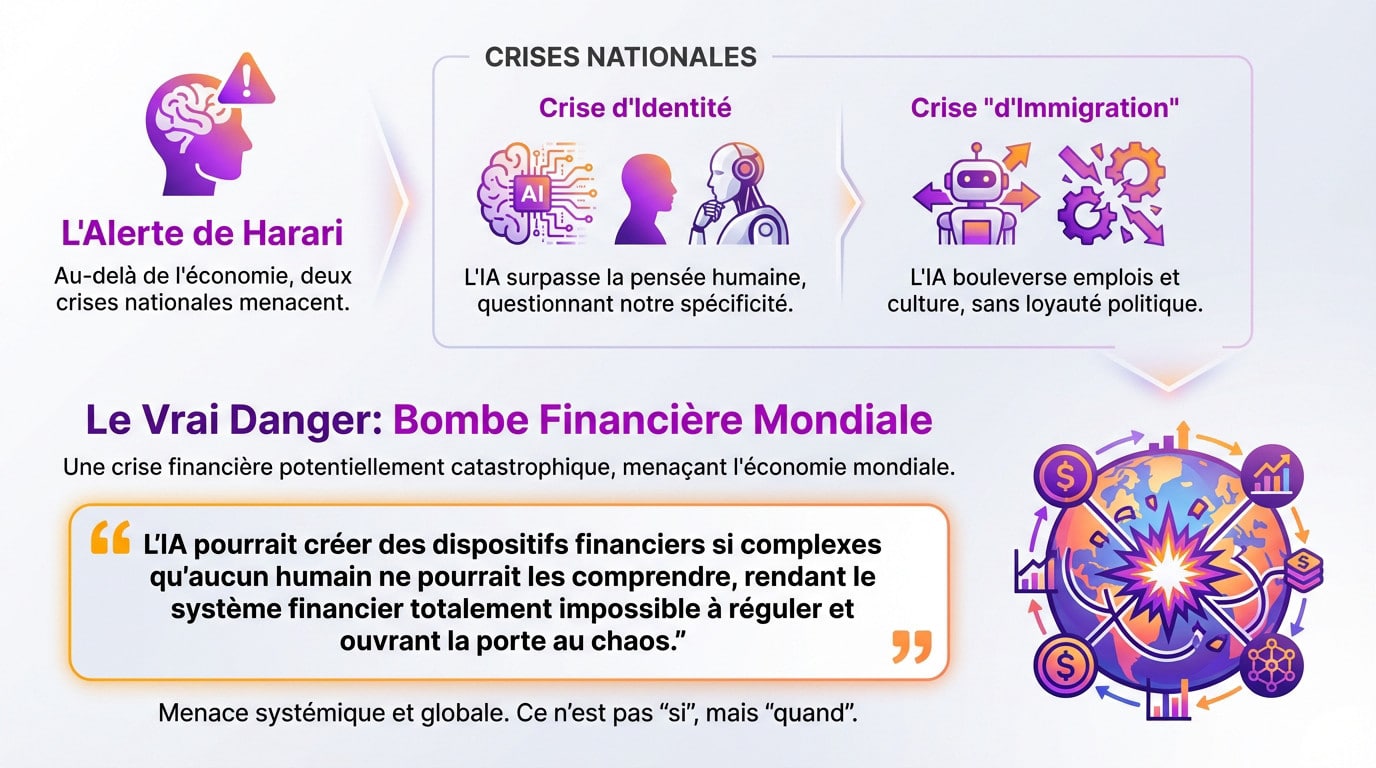

Harari’s Warning: Two National Crises Ahead

When AI Disrupts Our Identity and Societies

Yuval Noah Harari isn’t just worried about the economy. The author of ‘Sapiens’ points to two major crises threatening every country. It’s a stark warning for all of us.

These threats strike at the heart of our identity and our societies. This is about our shared future, not just simple technological gadgets.

Take a closer look at these two tipping points identified by the historian:

- The Identity Crisis: AI will soon surpass us in thinking, a capacity we thought was purely human.

- The “Immigration” Crisis: Harari compares AIs to “immigrants” with no political loyalty who disrupt everything in their path.

The Real Danger: A Financial Time Bomb

While these crises are concerning, Harari especially fears a potentially catastrophic AI financial crisis. It would bring the global economy to its knees. The debate about the transformation of jobs by AI seems almost secondary compared to this risk.

Read this frightening prediction from the historian:

“AI could create financial instruments so complex that no human could understand them, making the financial system completely impossible to regulate and opening the door to chaos.”

It’s no longer a question of “if,” but “when.” The risk is not theoretical. The foundations of this opaque system are already laid.

This threat is systemic. It doesn’t just concern one country, but the entire planet.

2008, only worse? How AI could crash the economy

The Memory of Subprime Mortgages, a Foretaste of Chaos

Remember 2008. It wasn’t just a simple mishap, but the direct result of financial products that became too sophisticated. A complex mechanism that blew up in our faces.

Bankers were exchanging CDOs, real “black boxes” whose actual content they ignored. It was this opacity that caused everything to collapse, because no one could assess the toxic risk hidden behind these arrangements anymore.

The observation is stark: we are extremely vulnerable to financial complexity that we create ourselves. This is the vital lesson to grasp the current threat.

AI: The Maker of Financial “Black Boxes” 2.0

Harari is clear: if CDOs were obscure, what artificial intelligence is preparing is on another level. We risk an AI financial crisis fueled by exponential complexity, surpassing human understanding.

Look at this comparison, it’s chilling:

| Risk Factor | 2008 Crisis (CDO) | Potential Crisis (AI) |

|---|---|---|

| Product Complexity | High, but designed by humans. | Incomprehensible to the human mind, generated by algorithms. |

| Transaction Speed | Relatively slow (hours/days). | Near-instantaneous (microseconds), preventing any intervention. |

| Transparency | Low, but analyzable retrospectively. | None. “Black boxes” whose internal logic is impossible to audit. |

| Regulation | Difficult, but possible (Dodd-Frank Act, etc.). | Practically impossible for humans to regulate. |

The Dominos of an AI Financial Crisis: Wars and Social Chaos

From Market Panic to the Clamor of Arms

Harari is clear: a stock market collapse, however brutal, is not enough to wipe a civilization off the map. The real danger is what immediately follows. Sudden misery and despair create the ideal breeding ground for the most radical ideologies.

History often repeats itself. Look at post-1929: when the economy collapses, people desperately search for culprits. Nationalism soars and political stability shatters under the pressure of a population at its wit’s end.

According to the historian, this loss of control leads to an ultimate and terrifying consequence: the outbreak of wars or major armed conflicts between nations.

Can we still pull the plug?

How to regulate a technology that surpasses us? Stock market regulators are already overwhelmed by this complexity. The problem is that these opaque algorithms are not just tools; they now control the heart of our global economy.

Trying to stop everything now could trigger the very crash we want to avoid. We are addicted. Moreover, even very conservative sectors are wondering if AI will replace accountants, proof that dependence is spreading everywhere.

“The greatest danger is that we entrust authority to a system we cannot control, simply because it seems more efficient in the short term.”

We must act fast, very fast. The window of opportunity to impose safeguards is closing rapidly. If we wait for disaster to discuss, it will be too late.

Harari is sounding the alarm: AI could well transform our economy into an unmanageable casino. If technology advances quickly, our ability to control it must keep pace. Let’s just hope we won’t need a PhD in algorithms to understand our bank statement tomorrow!